Financial Literacy in bite sizes

July 24, 2023

Start building your budget by listing all your income. The most common is salary income. However there are other incomes that you may not have though of such as, such as benefits or rental income, etc.

#budgeting #income

July 25, 2023

List your expenses. First find all the expenses that you NEED to pay for each month, such as rent, utilities, groceries, insurance, etc. Then find the expenses that you WANT to have, such as sports, entertainment, eating out, holidays, hobbies, etc. Prioritise NEEDS over WANTS.

#budgeting #expenses

July 27, 2023

Add all your income up, then your NEED expenses and finally your WANT expenses. Check that NEED expenses plus the WANT expenses are less than your total income. If expenses outweigh income, you will go into debt!

#budgeting

July 29, 2023

If your TOTAL expenses outweigh your income, then start with your WANT expenses and see where you can trim expenses to be able to spend less than you earn.

#budgeting

July 31, 2023

To avoid getting into financial trouble, budgets should always balance. This means that expenses do not exceed household income, and the difference can be used to start saving.

#budgetbalancing

Aug. 2, 2023

To balance a budget you can either try to increase your income or reduce your expenses. Even better if you can accomplish both. Unfortunately, there is no other way, money doesn't grown on trees!

#budgetbalancing

Aug. 3, 2023

There are many ways to reduce expenses, and a number of ways to help increase or supplement your income. Look our for MoneyTip posts with ways to do this.

#budgetbalancing

Aug. 5, 2023

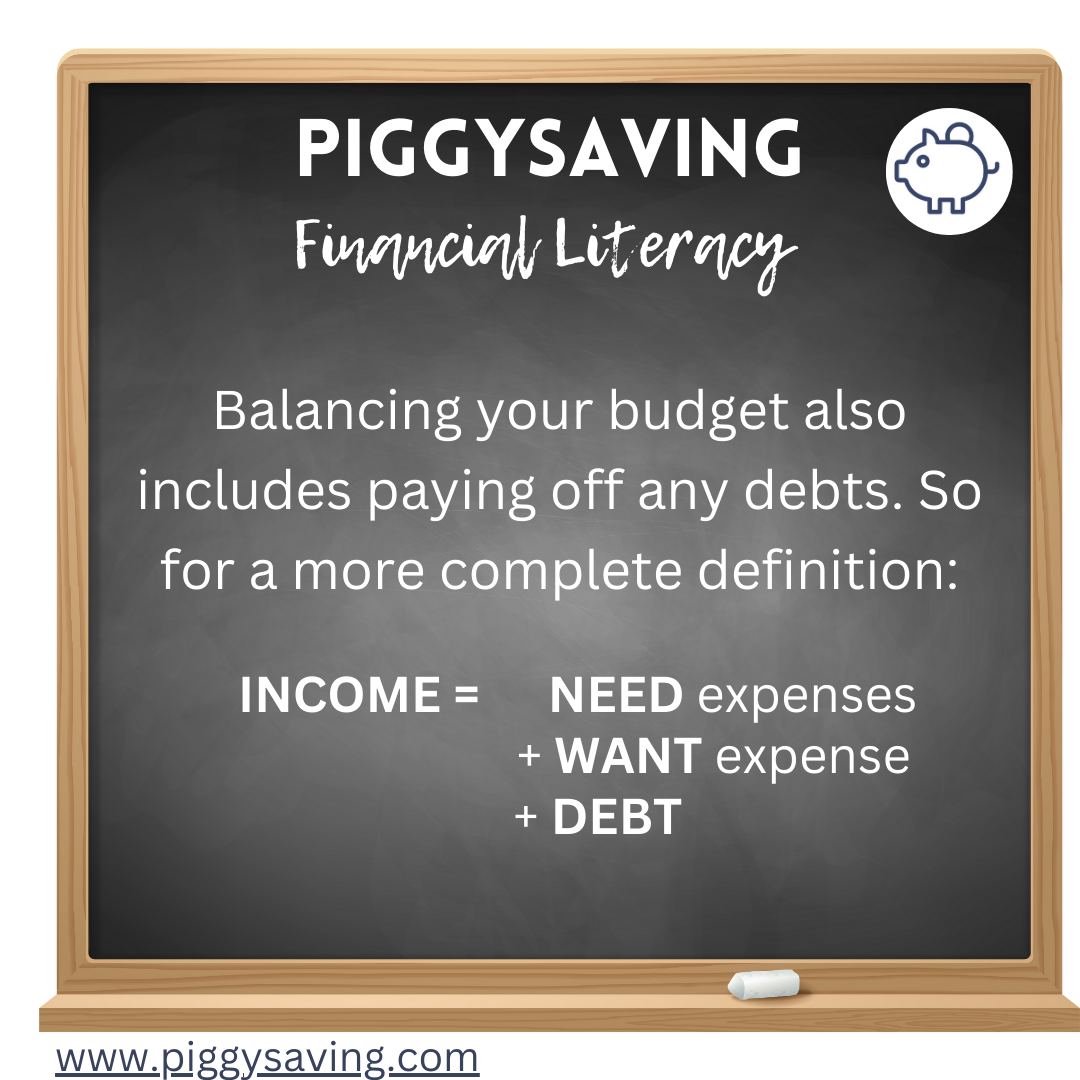

Balancing your budget also includes paying off any debts. So for a more complete definition: Income = NEED expenses + WANT expense +DEBT

#income #expenses #budgetbalancing

Aug. 7, 2023

Once your budget is balanced, it is time to start working towards either a 70/20/10 or 50/30/20 rule (to be explained soon). This, in turn will help accelerate paying off any debt, leading to fiscal independence.

#budgetbalancing #70/20/10rule #50/30/20rule

Aug. 9, 2023

The 70/20/10 rule means that your NEED expenses are 70% of your income, your WANT expenses are 20% of your income and you are able to SAVE 10% of your income. If you have debt, then you can use the 10% savings to pay it off faster.

#budgeting #income #expenses #70/20/10rule