Financial Literacy in bite sizes

Aug. 10, 2023

The 50/30/20 rule means that your NEED expenses are 50% of your income, your WANT expenses are 30% of your income and you are able to SAVE 20% of your income every month.

#budgeting #income #expenses #50/30/20rule

Aug. 14, 2023

The 70/20/10 rule is a good target to work towards once you have a balanced budget (your total expenses = your income). The key is being able to start saving money.

#budgeting #70/20/10rule

Aug. 15, 2023

From the 70/20/10 rule, you can work towards the 50/30/20 rule. Saving 20% of your salary will quickly add up over time.

#budgeting #70/20/10rule

Aug. 17, 2023

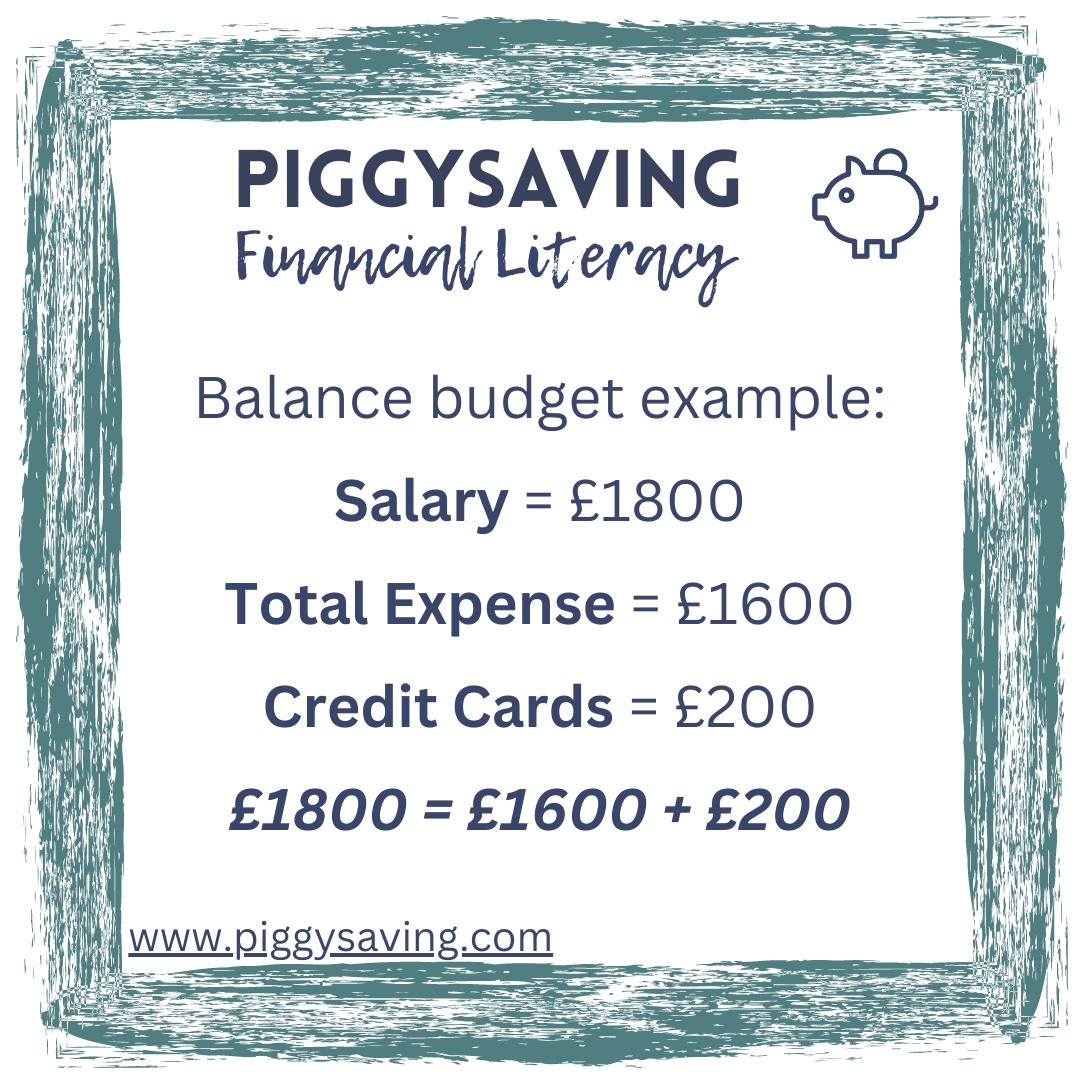

Balance budget example Salary = £1800 Total expense = £1600 Credit Cards = £200 £1800 = £1600 +£200

#budgetbalancing

Aug. 18, 2023

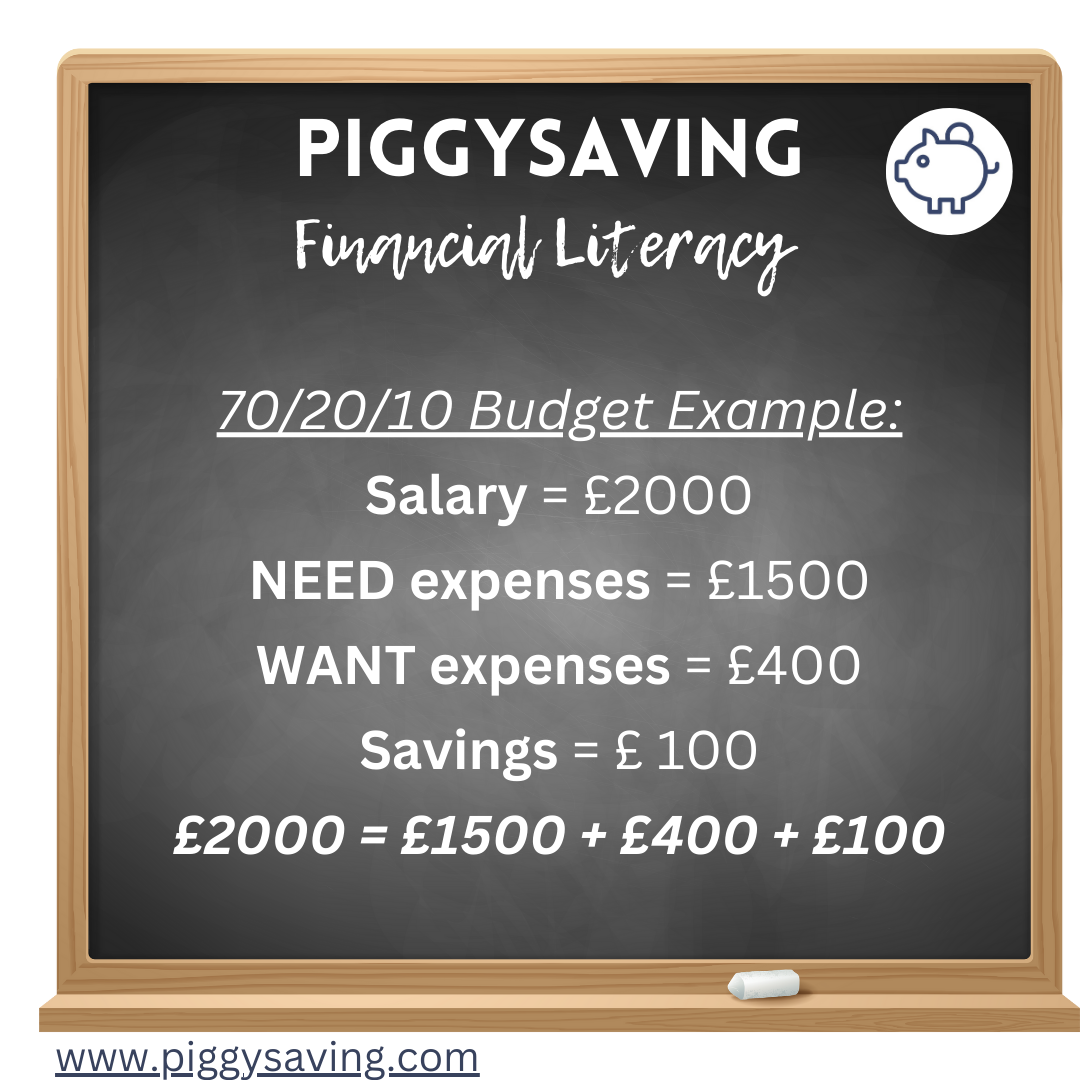

70/20/10 Budget Example: Salary = £2000 NEED expenses = £1500 WANT expenses = £400 Savings = £ 100 £2000 = £1500 +£400 + £100

#budgeting #70/20/10rule

Aug. 22, 2023

Expenses can be either Fixed or Variable. Fixed means that they do not change from month to month. For example rent or insurance. Another way to consider fixed expenses is that you know what the expense is each month for a set number of months.

#fixedexpenses

Aug. 23, 2023

Fixed expense are pre-determined by somebody other than yourself, eg: a bank or a company. The only control you have is to shop around (eg: for car insurance) and potentially try negotiate the cost.

#fixedexpenses

Aug. 25, 2023

Variable expenses can change on a month to month basis. For example: groceries or eating out. These are harder to predict than fixed expenses.

#variableexpenses

Aug. 26, 2023

You have more control over variable expenses and hence are able to reduce them easier and more quickly than fixed expenses.

#variableexpenses

Aug. 28, 2023

Ever stuck choosing between 2 similar products but of different sizes? Which is a better deal? It's time to look at the unit price for each of the products and see which is smaller - that's the better deal!

#unitpricing